We strive to build long term relationships to support the operational and strategic focus of the organisation.

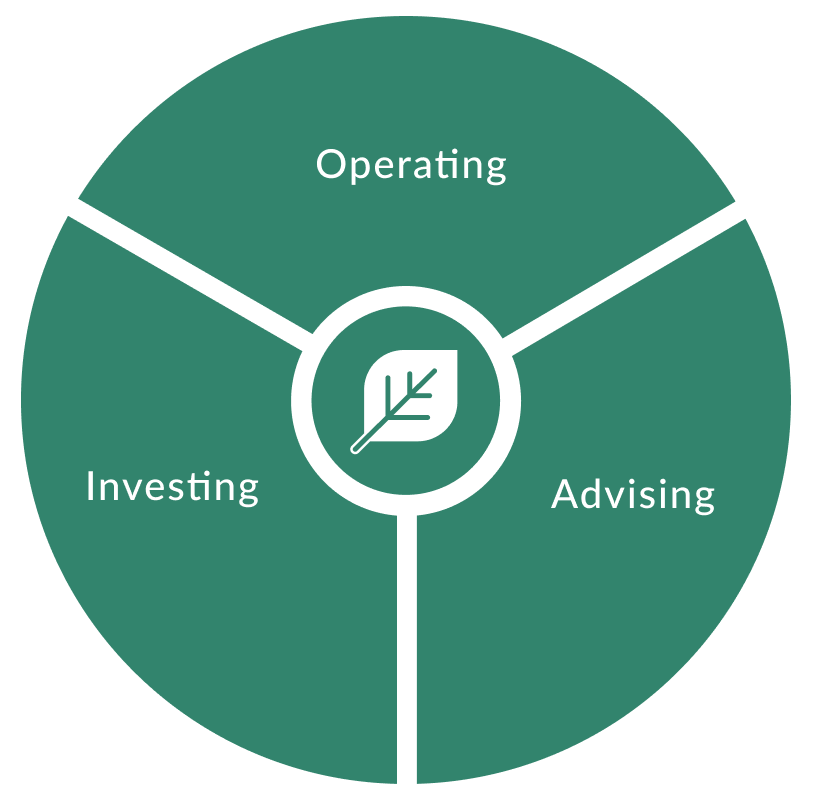

Originating and executing deals to invest capital across targeted sectors and special situations

Supporting SME operators to deliver a comprehensive suite of Care and Operational services

Innovative market proven advisory services to operators, investors and sector stakeholders

As a Care Home owner and operator, our advice is not just from text books, but from real life experience and in-depth operating knowledge of the sector, which is why our ideas, advice and access to funders is received with confidence, and funders respect our advice.

Our experienced team bring dynamic solutions to situations to enable clients to achieve their long term goals.

Hervines assists operators across skill sets, from development, operations, to finance and working with your existing funders, and across different time periods, whether it be acquisitive or stressed, or just want to get activities in order

Capital can be injected to help clients through uncertain times to implement a carefully constructed turnaround / restructuring plan to ensure the business continues on a steady path.

Exit opportunities will be sourced following maturity through private equity investment or business sale with the strategy of taking clients to the point where mainstream investors get interested.